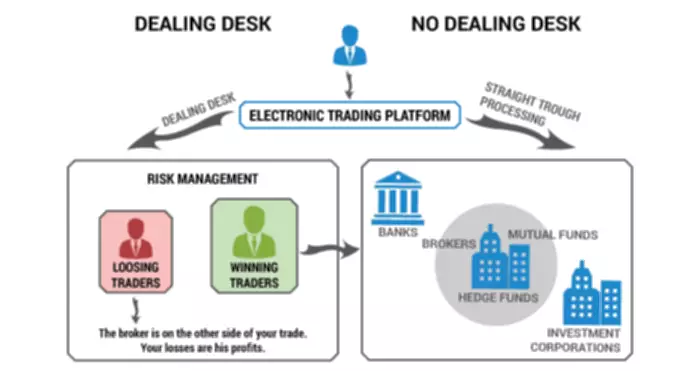

Index options track bigger stock market indexes, such as the S&P 500 and Nasdaq. These broad-based indexes cowl many sectors and are good measures of the general economy. Stocks have a bent to be correlated; they generally move in the same direction, especially throughout instances of higher volatility. All retail forex trades are bilateral since your retail forex “broker “is the counterparty to ALL of your trades. All orders and trades entered through your broker’s trading platform are NOT executed on an exterior buying and selling venue but are executed by the dealer itself. If you take the time to understand how orders are executed, then you’ll be able to differentiate between forex brokers and can make a more knowledgeable determination when selecting one.

- Bond laddering involves buying bonds with staggered maturity dates, which helps to manage reinvestment threat and allows investors to benefit from adjustments in rates of interest over time.

- However, if the funding loses cash, and your hedge was profitable, you should have reduced your loss.

- Our group of reviewers are established professionals with decades of expertise in areas of personal finance and maintain many advanced degrees and certifications.

- Based on the shopper’s wants and threat tolerance, a personalized hedging strategy must be developed, bearing in mind the assorted financial devices and hedging methods out there.

An imperfect hedge in foreign foreign money trading is where you utilize put options contracts to offset an existing place. This might not always be attainable through your trading platform, however foreign exchange choices are available at Saxo Bank. This price is dependent upon an organization’s view of commodity value flooring and ceilings. A massive independent natural-gas producer, for example, was evaluating a hedge for its manufacturing through the coming two years. The worth of pure fuel in the futures markets was $5.50 per million British thermal items (BTUs). The company’s elementary perspective was that gasoline costs in the next two years would stay inside a spread of $5.00 to $8.00 per million BTUs.

Portfolio Hedging

The theory examines the correlation between totally different assets, as properly as the volatility of property, to create an optimal portfolio. In this scenario, if the dealer doesn’t have the funds, it did not handle its market risk properly. In concept, the broker may cease accepting the trades if it didn’t wish to expose itself to such threat but https://www.xcritical.in/ then that may imply that every one of its prospects couldn’t enter into any more trades. Of course, the broker has to generate income so it quotes a different worth depending on whether the shopper wants to purchase or sell. Each dealer trades instantly (“bilaterally”) with the broker, and solely the retail dealer.

However, like any form of investment, it comes with its fair share of risks. Hedging in forex includes taking positions that offset potential losses in other positions. In this beginner’s guide, we will explore the idea of hedging and the means it may help you manage threat in the foreign exchange market. Prime Codex is operated by Prime Codex LLC and has registered in Saint Vincent & the Grenadines with LLC quantity 892 LLC 2021. We have all heard the phrase “high risk, excessive return” in relation to the monetary market.

Insights From Constancy Wealth Management

The same factor occurs if you need to sell or “go short”, the dealer will take the alternative facet of your commerce and buy from you or “go long”. This signifies that if you wish to purchase or “go long”, the broker will take the opposite facet of your commerce and sell to you or “go short”. It offers you a method to make bets on forex costs by at all times taking the alternative of your bets everytime you wish to make one. It’s not looking for someone to take the opposite facet of the guess, it merely takes the wager on itself. But a foreign exchange dealer does not act in your behalf, nor is it obligated to act in your greatest curiosity.

That makes hedging a useful tool within the short-term however not as efficient within the long-term. For long-term investing might make more revenue holding a profitable single position, compared to a successful hedged place. Many threat managers underestimate the true price of hedging, usually focusing solely on the direct transactional costs, similar to bid–ask spreads and dealer charges. These elements are often only a small portion of whole hedge costs (Exhibit 1), leaving out indirect ones, which can be the most important portion of the entire. As a outcome, the cost of many hedging programs far exceeds their profit.

Currency hedging aims to handle the chance of fluctuations in overseas trade rates, which might influence worldwide investments. Bond laddering includes purchasing bonds with staggered maturity dates, which helps to handle reinvestment risk and permits buyers to benefit from changes in interest rates over time. Derivatives, corresponding to options, futures, and swaps, can be used to handle particular dangers inside the portfolio successfully. Asset allocation is the method of dividing an funding portfolio among totally different asset classes, corresponding to stocks, bonds, and money. A well-diversified asset allocation may help to scale back total portfolio threat and improve returns. Life insurance coverage insurance policies provide monetary protection for beneficiaries in case of the policyholder’s death.

Furthermore, it’s essential to have a clear understanding of your risk tolerance and objectives earlier than employing any hedging technique. Hedging ought to be used as a device to mitigate threat quite than as a method to speculate on the market. It’s essential to take care of a balance between risk management and revenue potential.

A protective put includes buying a draw back put possibility (i.e., one with a lower strike price than the current market worth of the underlying asset). The put offers you the best (but not the obligation) to promote the underlying inventory on the strike worth earlier than it expires. So, when you personal XYZ inventory from $100 and want to hedge against a 10% loss, you can buy the 90-strike put.

Get Any Monetary Question Answered

Derivatives are monetary devices whose value depends on the efficiency of an underlying asset, index, or rate of interest. They are widely utilized in hedging methods to handle different varieties of risks. There are several methods that merchants can make use of to hedge their forex positions. Correlation is a statistical measure of how two foreign money pairs move in relation to each other. For instance, if two foreign money pairs have a optimistic correlation, it implies that they tend to move in the identical course.

Investopedia does not present tax, funding, or financial companies and advice. The data is presented without consideration of the funding goals, danger tolerance, or financial circumstances of any particular investor and might not be appropriate for all investors. There weren’t any other traders who wished to quick GBP/USD so the broker wasn’t able to offset any positions to help scale back his net short place. Assuming this is all of the GBP/USD positions that the broker has on its guide, its market threat publicity is zero.

For instance, all retail foreign exchange brokers regulated in the united states are formally known as “Retail Foreign Exchange Dealers” or RFEDs. However, that doesn’t make this a risk-free technique because by eliminating the chance you’ll lose cash, you’re also eliminating your probability of constructing a profit. This is because the cash you make from one place is cancelled out by the money you lose from the opposing place. If a broker has customer orders that can offset each other partially, then the broker is left with a a lot Broker Risk Management smaller web position that leaves the dealer uncovered to market danger. The primary risk for a dealer operating the Internalization model happens when positions are not fully offset, leaving the broker with publicity to price movements which might end in a loss. Instead of managing risk for every particular person trade, a dealer can mixture buyer trades that every one comprise the identical forex pair.

The time period “hedging” refers back to the course of the place a forex broker reduces market danger publicity by getting into into a parallel transaction with one other entity (a “liquidity provider”). Options are contracts that present the right, but not the obligation, to purchase or promote an underlying asset at a predetermined price before a specified expiration date. Options can be utilized to hedge against potential worth movements in shares, bonds, and other property. Hedging may additionally be utilized in other areas, similar to in agriculture, where farmers might use futures contracts to lock in costs for their crops and shield against value fluctuations.

Be suspicious of any broker who isn’t clear with its hedging policy which should detail not solely its hedging practices however disclose its hedging counterparties (its “liquidity providers”). Hedging is a strategy used to minimize back or mitigate threat in numerous industries and markets. The use of derivatives and other monetary instruments for hedging might have regulatory and tax implications that should be carefully thought-about. Commodity hedging is used to handle the chance of price fluctuations in commodities similar to oil, gold, and agricultural merchandise. Forward contracts can be used to hedge towards currency danger by locking in an exchange price for a future transaction. This may be carried out if the hedge is now not needed, if the value of the hedge is simply too high, or if one seeks to take on the extra danger of an unhedged place.

Great! Hit “submit” And An Advisor Will Ship You The Guide Shortly

They have complete danger management insurance policies in place that decide their threat limits and govern the utmost market threat they’ll undertake. Keep in mind that web economic publicity consists of indirect dangers, which in some cases account for the majority of a company’s whole risk publicity.2 2. Indirect risks arise as a outcome of changes in competitors’ cost structures, disruption within the supply chain, disruption of distribution channels, and shifts in customer habits. Companies could be exposed to oblique dangers by way of both enterprise practices (such as contracting phrases with customers) and market elements (for occasion, modifications in the competitive environment). However, the prices for the company’s US rivals were in depreciating US dollars.

Why You Can Trust Finance Strategists

This means you imagine the worth of this foreign money pair will increase and, subsequently, you’re keen to carry it for an extended interval. CFDs are advanced instruments and include a high threat of losing cash quickly as a outcome of leverage. 62% of retail investor accounts lose money when buying and selling CFDs with this provider. You ought to think about whether you perceive how CFDs, FX or any of our different products work and whether you’ll be able to afford to take the excessive threat of losing your money. When a dealer matches one customer’s commerce with one other customer’s, it removes the market risk in an identical manner to hedging the commerce with an external liquidity provider (LP).

How Comfortable Are You With Investing?

For instance, if the dealer is using STP execution, the execution of many small purchase orders one by one may “signal” to an LP that this sample might proceed. If your broker doesn’t want to disclose any of those particulars, it may be an excellent time to find a dealer who will. This is the place incoming trades are internalized earlier than any trades are externally hedged.

Hedging doesn’t remove all threat and, in situations where it does, your web profit shall be zero. Even in situations where you strive your finest to eliminate your risk and end with a web profit of zero, you may have to pay trading fees, and in that case you’d actually lose money with an ideal hedge. However, let’s say there are some political events in America that make you wonder if there could additionally be some volatility within the quick or medium time period.